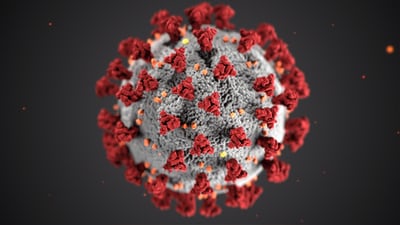

COVID-19 has been a stark reminder that we do not know what our future brings. We do not know what is around the corner that may affect our ability to care for ourselves or our loved ones. To deal with the virus, we should all do what can to care for our neighbors and communities by staying home if we are sick, wearing a mask, washing our hands frequently, and implementing any other steps recommended by health experts.

The virus has been a reminder to us all, we do not know when accident or illness may strike. None of us know what tomorrow may bring. If you have been putting off creating or updating an estate plan, there is no better time than now to move forward. For your own peace of mind and the good of your loved ones, it is important to stop procrastinating.

There are several key documents an estate plan should include to protect you and your family if you should suddenly become very ill or pass away:

Last Will and Testament and/or a Trust

A will enables you to specify the individuals you would like to receive your money and property after you pass away. In addition, you can name a guardian(s) to care for your children or other dependents if you are unable to do so and a conservator to handle their financial needs. For many, however, a will alone is not the best solution.

In a revocable living trust, you can name yourself as a trustee and continue to exercise control over the assets you transfer to the trust. In addition, you can name a co-trustee or successor trustee who can manage your money and assets for your benefit and the benefit of any other beneficiaries of the trust if you become unable to do it yourself. Further, your trust can specify when and how the assets should be distributed to your beneficiaries when you pass away. If you have transferred all of your assets into the trust, it will not have to go through the probate process, either during time that you are incapacitated or after your death, a process which can be expensive, time consuming, and open to any member of the public.

For some, other types of trusts may be appropriate to achieve particular goals, for example, protecting assets from creditors or providing for a child with special needs.

Note: If you do not create a will or trust specifying who you would like to receive your money and assets when you die, state law will determine who will receive shares of your estate. The state’s choices may be vastly different from what you would have specified in your estate planning. Probate is required if you die without a will or trust to put the state’s plan into place. In addition, a court will have to appoint a guardian and/or conservator to care for your children—and the person appointed may not be the individual you would have chosen.

Powers of Attorney

Using a power of attorney, you can name people you trust to make decisions on your behalf if you become ill and are unable to make them for yourself. Even if you are married, your spouse does not have the authority to make all of these types of decisions for you. You must give that authority, or the probate court will give that authority.

A healthcare power of attorney can be used to name a trusted person as your agent (patient advocate) to make medical decisions on your behalf if you are unconscious or otherwise unable to communicate with your health care provider. As your agent, the person you have named is required to act in accordance with your wishes to the extent that they are known to that individual, so it is important to communicate important information regarding your preferred providers, medical conditions, treatments you do not want, religious convictions, and other pertinent information.

A durable financial power of attorney will allow the person you have named as your agent to make financial decisions and conduct business on your behalf if you cannot handle these matters for yourself. It can be as broad or as limited as you choose: For example, you could authorize a trusted individual to run your business for you, or you could simply authorize another person to write checks and pay your bills on your behalf.

Note: If you do not name trusted individuals to act for you in medical and financial powers of attorney, your family members, including your spouse under some circumstances, will have to go to court to be appointed to this role. As in the situation in which you do not have a will or trust, you no longer have any control over who is named to act on your behalf. The person appointed by the court may not be the person you would have wanted to take on these important roles.

Advance Directive/Living Will

Your advance directive, also known as a living will, is a document that clearly spells out your wishes for the end of your life, for example, whether or not you want to be placed on life support if you are in a vegetative state or have a terminal condition. This document allows your family and health care providers to understand your wishes even if you are no longer able to communicate them. In Michigan, this directive is often included in the healthcare power of attorney.

Funeral Planning

You can use a memorial and services memorandum to provide information to your family and loved ones about your wishes for your service, people who should be notified when you pass away, instructions regarding your remains, and information you would like to be included in your obituary. If you do not provide this information in advance, your grieving family will be left to guess about what you would have wanted after you pass away. This could lead to unnecessary stress and conflict at a time when they are likely to be feeling emotionally overwrought.

Give Us a Call

COVID-19 has given us an important reminder of just how important it is, not only to us, but also to our family members and loved ones, to have an estate plan in place in case the unexpected happens. With proper planning, you can have confidence that if you become ill, your own care and the needs of your loved ones will be addressed. Call us today to set up a meeting. We are available to meet either in-person or virtually.