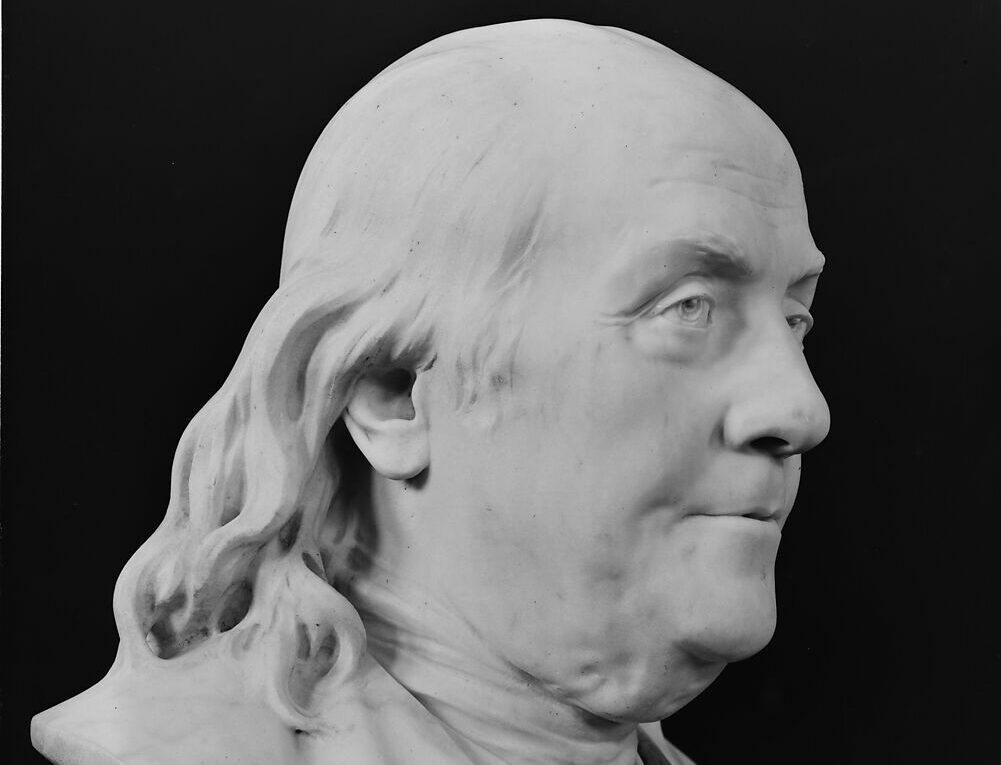

Estate planning is a crucial process that allows individuals to protect their assets and ensure their wishes are carried out after their passing. Benjamin Franklin, one of the Founding Fathers of the United States, left behind a rich legacy, not only in his accomplishments but also in his estate planning. By examining Franklin’s planning, we can extract valuable lessons that can guide us in creating our own effective estate plans.

Clarity in Expressing Intentions

Benjamin Franklin’s wills and codicils showcase his meticulous attention to detail and clarity in expressing his intentions. He left specific instructions regarding the distribution of his assets, including properties, investments, and intellectual property rights. Franklin’s emphasis on clarity emphasizes the importance of being precise in our estate planning documents.

Lesson: Be Clear and Specific – Clearly articulate your wishes and intentions in your estate planning documents to avoid ambiguity and potential disputes among beneficiaries.

Provision for Loved Ones

Franklin’s estate plan included provisions to provide for his daughter, Sarah Franklin Bache, and her family. He established trusts to ensure ongoing financial support and protection for their well-being. Franklin’s consideration for his loved ones demonstrates the importance of making adequate provisions for family members in our own estate plans. Franklin also left property to his son, William, even though the two were estranged as a result of William’s loyalty to England during the American Revolution.

Lesson: Provide for Your Loved Ones – Take into account the financial needs and security of your family members by incorporating appropriate provisions, such as trusts or beneficiary designations, in your estate plan.

Charitable Contributions

Philanthropy played a significant role in Benjamin Franklin’s estate planning. His will directed a sum of money to be distributed to be held in trust to support the cities of Boston and Philadelphia, specifically to provide loans for young artisans to start their own businesses. Franklin’s dedication to giving back highlights the impact charitable contributions can have on society.

Lesson: Incorporate Charitable Giving – Consider including provisions for charitable donations in your estate plan to support causes that align with your values and make a positive impact in your community or beyond.

Executor Appointment

In his will, Benjamin Franklin designated trusted individuals to serve as executors of his estate. These individuals were responsible for ensuring the proper administration and distribution of his assets according to his wishes. Franklin’s careful selection of executors emphasizes the importance of choosing responsible and trustworthy individuals to handle the execution of your estate plan.

Lesson: Choose Reliable Executors – Select individuals who are capable, trustworthy, and willing to carry out your estate plan effectively as executors or trustees.

Regular Updates

Throughout his life, Benjamin Franklin made revisions to his wills and codicils to reflect changes in his circumstances and wishes. He was committed to keeping his estate plan up to date and aligned with his evolving needs.

Lesson: Regularly Review and Update – Schedule periodic reviews of your estate plan to ensure it remains current and reflects any changes in your family situation, financial status, or personal preferences.

Conclusion

We can learn valuable lessons in estate planning by examining Benjamin Franklin’s planning. His emphasis on clarity, provision for loved ones, philanthropy, the selection of reliable executors, and the importance of regular updates serve as guiding principles for creating effective estate plans. Let the wisdom of one of the Founding Fathers inspire and inform your own estate planning journey, ensuring the preservation of your legacy and the fulfillment of your wishes.